April 2020

The world may have hit a peak in toilet paper sales but it is likely most households and businesses will be reaching peak debt and beyond in the foreseeable future. Banks have allowed businesses affected by COVID-19 to defer loan repayments for the next six months, however, loan balances will continue to grow as interest is capitalised. The government has subsidised wages and suspended the ability of landlords to evict tenants for non-payment of rent during this period. This is hopefully expected to help many businesses through this “hibernation” period. The big unknown is how many businesses will survive in the post-hibernation world when we eventually emerge from the restrictions and lockdowns.

Peak Debt

Lenders and borrowers are having to make extremely difficult decisions as to which businesses will survive and those that will fail. This decision is not just about being able to survive during the next 6 months but also the following 12 to 24 months. In this article I look at the concept of peak debt as a frame for lenders and borrowers to consider their current circumstances.

The approach is individualised for the circumstances of the borrower. For business/corporate borrowers key considerations include industry dynamics, competitive position, supply and demand dynamics, cost structures and working capital cycles. The financial assessment is based on cash flow lending concepts rather than use of accounting earnings or behavioural measures to determine whether the borrower will be viable. Notwithstanding that additional working capital loans are guaranteed by the Government, lenders and borrowers need to ensure that these loans will not result in greater hardship further down the road.

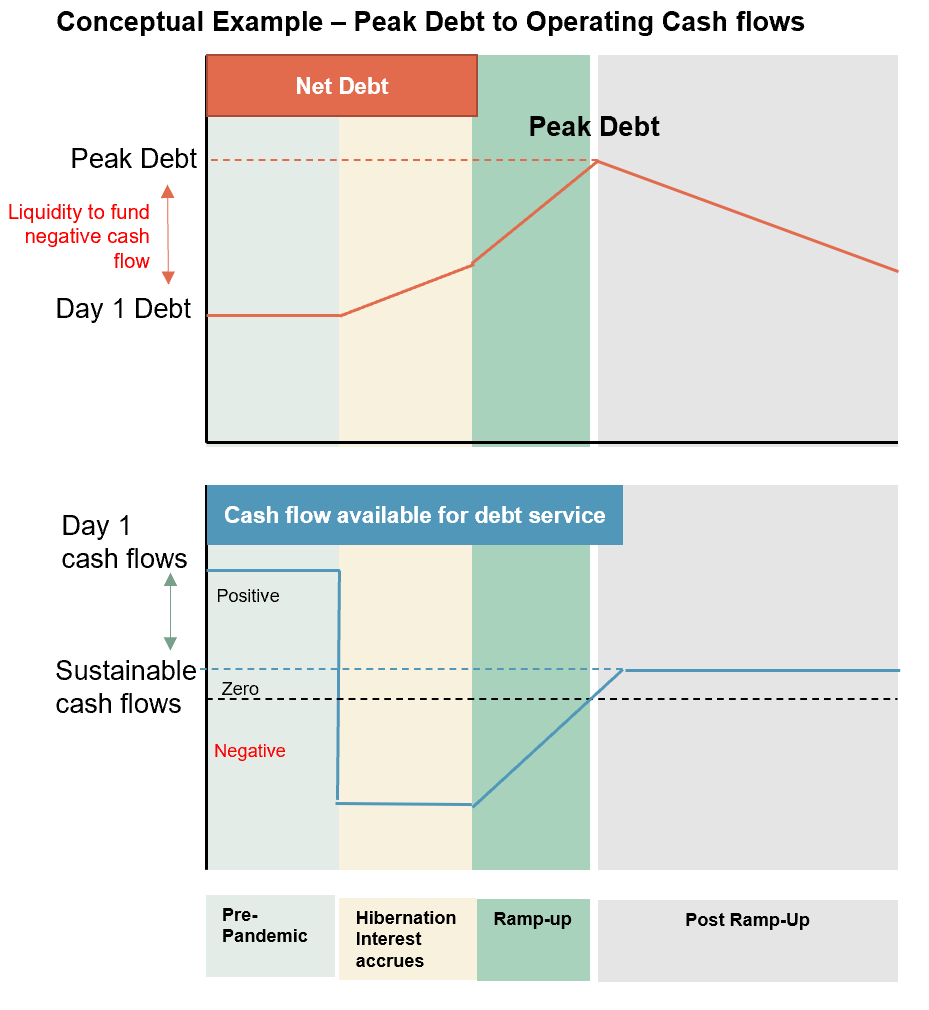

Businesses will need to determine whether they have sufficient liquidity to trade through the following horizons:

(a) Hibernation period – the initial six months period (where no revenue is being earned), debt balances are increasing as interest obligations are capitalising. During this period Governments are providing assistance measures including subsidising wages;

(b) Ramp up period – the emergence out of hibernation as business activity ramps up (most likely burning cash with debt balances continuing to grow); and

(c) Post ramp up period – forecast sustainable earnings are achieved with debt balances stabilising and/or starting to fall

Forecasts are prepared to determine how much additional debt is required to get to the post ramp up period and still be able to service debt.

Post hibernation forecast earnings and operating cash flows

Obviously the world will be different post COVID-19. The household, private and public sectors will be extremely leveraged with high levels of unemployment. Businesses that are exposed to cyclical changes in economic conditions (slower economic growth) will be impacted more than others. The hibernation is also likely to result in structural changes in the way consumers purchase goods and services (i.e. expect high take up of online vs bricks and mortar sales).

Forecasts need to factor in the ramp up of sales activity as businesses re-open. During this period there may be working capital and other obligations that will need funding. Assumptions may also need to consider the impact of the government assistance programs winding down.

Business will need to realistically consider whether forecast revenues before the pandemic will be achievable. For some businesses this may be easier to predict than others. Assumptions around asset sales in terms of length of sale and value may also need to be discounted to reflect the potential lack of liquidity for assets (e.g. property).

Capacity to repay Peak Debt levels

The final consideration is bringing this all together – whether the additional indebtedness of the borrowers can be serviced firstly on an interest only basis but also can be reduced to more sustainable levels sooner rather than later. The peak debt amount is where the borrower can no longer service its debt obligations based on its sustainable cash flows from operations. Businesses that were at peak debt level prior to the outbreak of COVID-19 are unlikely to have the financial capacity to service additional debt obligations if they do not have access to other sources of liquidity (e.g. asset sales, cash reserves, etc).

Challenges for lenders

Many banks will struggle not just in terms of resourcing the volume of restructurings but also having the credit risk skills to make these assessments. Some of the challenges that lenders will face include:

Legal, compliance and reputational considerations – In the case of consumer lending such as personal loans, credit cards and residential mortgages, the risk of breaching responsible lending obligations is expected to be higher without the appropriate controls and governance structures. If not managed adequately, lenders will be exposed to higher levels of operational, conduct and reputational risks.

Availability of experienced loan workout resources– Many bankers that worked in problem asset management and loan recovery roles during the GFC have retired. In addition, the impact of the downturn and number of businesses affected is likely to be much broader and severe than that experienced during the GFC. Watchlists and other monitoring controls are also expected to increase significantly in the foreseeable future.

System and reporting capabilities – stakeholders will be demanding timely and reliable data of portfolio characteristics and account management activity. Data and portfolio reporting will be a challenge for lenders that have under-invested in credit risk management systems over the past 10 years.

Understanding the implications of implementing the various restructuring solutions on provisions, arrears reporting, and capital from a regulatory and accounting perspective – Whilst APRA has relaxed arrears reporting requirements for deferring loan repayments, lenders need to consider the implications post this period including impacts on provisioning, arrears, migration of asset quality metrics and flow on impacts on regulatory capital and provisioning models. Thinking through these scenarios at this point in time and understanding the implications is especially important. APRA has flagged that it will provide ADIs with further guidance regarding the deferral of repayments and associated regulatory implications. There are areas that will require further clarification as you look at the detail. This was something we saw when APRA released its letter to ADIs regarding hardship arrangements in August 2012.

Valuations and assumptions used in impairment testing – Determining asset prices during this period will be challenging especially in the absence of recent sales. Valuers will also be struggling with determining valuations. Caution should also be taken when using alternative valuation methods especially model based ones that are reliant on recent sales before the pandemic. It is unlikely that valuations will be at the levels they were last month, let alone prior. Approaches to impairment testing will need to ensure that assumptions being used are appropriate, acknowledging that there is much uncertainty at this point in time.

How we can help

There are many challenges in the weeks and months ahead for the financial services industry and their customers. The priority is the ability to handle the volumes of customer inquiry and restructuring requirements. Governance and controls over this process remain important. We know this as former regulators and credit risk officers and now as small business owners.

Rhizome’s credit risk management practice can deliver unique advice based on a combination of regulatory and industry expertise. We have access to experienced retired credit risk officers that have worked through previous downturns. They help Rhizome deliver the highest quality advice and support with respect to problem asset management design and implementation, loan workout advice, regulatory considerations and portfolio assessments (including loan loss reviews).

Disclaimer:

This communication provides general information which is current at the time of production. The information contained in this communication does not constitute advice and should not be relied on as such. Professional advice should be sought prior to any action being taken in reliance on any of the information.