November 2020

Sector in focus: commercial real estate investment loan portfolio risk

Some light is starting to appear at the end of the tunnel after a turbulent year, with improving consumer confidence, record low interest rates, recovering house prices and the likelihood of an effective vaccine being rolled out in early 2021. House price declines have been lower than expected and are now heading back towards pre-pandemic highs. The increase in auctions / sales activity (including Melbourne) is providing comfort to banks about the reliability of valuations of the residential properties securing their mortgage portfolios.

However, commonly accepted ‘rules of thumb’ that are used to predict the expected performance of residential and commercial real estate sectors have been severely tested over the past six months. Unprecedented changes from COVID-19 requires a re-think of these rules in terms of how credit risks are managed and monitored going forward. There is considerable uncertainty about the financial position of small businesses which have been hardest hit by the pandemic and the flow-on impacts for commercial real estate investment lending. Additionally, the pandemic has accelerated changes in the structural demand for office and retail space.

Lenders with rich data and sophisticated portfolio management practices will be better positioned to navigate through this period of uncertainty – able to quickly identify opportunities to strategically adjust underwriting standards, policies and portfolio allocations with the requisite clarity and confidence.

The data dilemma

Do lenders have the data and systems to understand the rapid changes in underlying fundamentals that drive the performance of commercial real estate lending?

Unlike residential property, the performance characteristics for commercial real estate loans are not homogeneous. This introduces challenges for lenders in providing portfolio-level performance and risk insights to management, boards, shareholders, and regulators, including the hardest hit segments. Two key challenges in commercial real estate lending are:

- identifying cohorts of collateral (that have economically homogeneous characteristics); and

- processing the data to provide greater insights into the likelihood of default and loss.

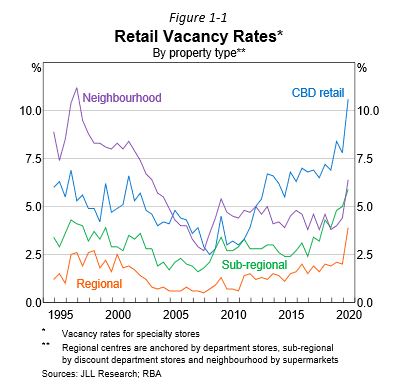

Some asset types, such as necessity-based retail tenants, food distribution and self-storage have performed strongly. Other asset types like non-necessity-based retail, backfill lower grade office and generally hospitality/hotels have performed poorly. Further, not all properties in the same asset type have identical performance characteristics when defined too broadly (e.g. retail, industrial, office, hotels). Over the past nine months, retail properties leased to cafés in Sydney CBD have performed noticeably differently to similar properties rented in a suburban area where demographics have rapidly changed. Figure 1-1 is taken from the RBA’s October 2020 Financial Stability Review shows how vacancy rates for different retail property types have spiked.

Valuation uncertainty is a considerable challenge, especially for asset types and locations where there have been no recent comparable sale or leasing evidence. Valuers have struggled to substantiate rental income forecasts, discount rates and cap rates being used. Lenders should play close attention to the assumptions and the disclaimers used by valuers particularly when looking to extend new credit to borrowers and reviewing the impact of valuations on existing exposures.

From a valuation perspective, cap rates and discount rates will become less relevant given the limited evidence available. What data is available and can it be substantiated? Rental income is likely to be the main factor that will drive valuations and provide comfort to lenders with limited sales evidence. Given this, it makes understanding and defining cohorts of asset types and tenants by economically homogeneous characteristics a priority for commercial real estate lenders.

Risks are looming in some segments

Where are the risks of tenant recession likely in commercial real estate investment lending portfolios?

Despite the good news scenarios populating the headlines, businesses and tenants have experienced cashflow stress during the pandemic. Businesses and tenants have deferred rents, negotiated reductions in either rental rates or areas rented, changed intentions to renew or exercise options to take up additional space, and in some cases, tenants have shut up shop for good and walked away (leaving the rental deposit behind for the landlords).

Noting the data limitations, for many lenders it is not clear how exposed their portfolios are to these recent and ongoing changes. Rather, portfolio reporting and disclosures have mainly focused on loan deferrals which has proven to provide a noisy picture of borrower stress.

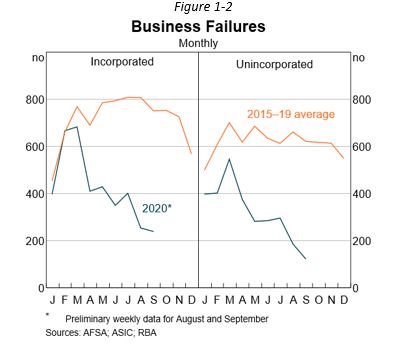

Insolvency rates, which also do not provide a complete picture of stress, for small businesses are at low levels as represented in the Business Failures chart (refer to figure 1-2). This is mainly due to the income support and insolvency relief measures that have been implemented since the start of the pandemic.

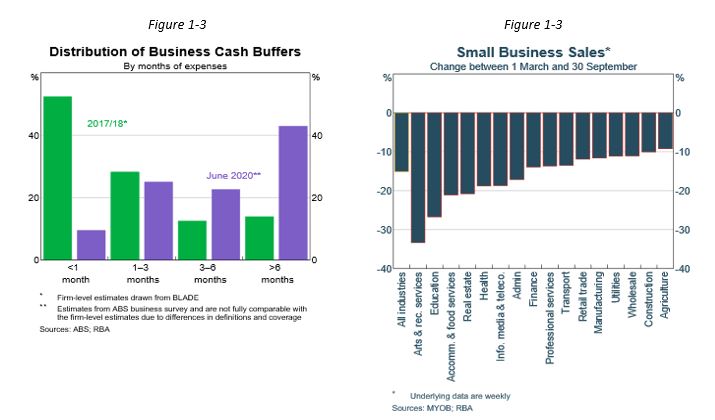

Some businesses have also used the pandemic to re-negotiate agreements with landlords. The RBA also highlighted (refer to Figure 1-3) that business cash buffers have increased markedly since the start of the year. As shown in the chart, more than 40 percent of businesses reported that they have sufficient savings to cover their current expenses for more than six months. Is this estimate reliable and to what extent is it an outcome of the stimulus going to businesses that are performing well during the pandemic?

Performance of specific sectors is still subject to uncertainty especially as government support packages for SMEs expire and structural demand for bricks and mortar retail and office space continues to rapidly change. The RBA also noted “[A]t least 10-15 percent of small businesses in hardest-hit industries still do not have enough cash on hand to meet their monthly expenses’. It is in these segments that the lenders need to look deep, to understand the flow-on impacts in commercial real estate investment loan portfolios.

Portfolio management capabilities

What are the tenant dynamics in your underlying collateral portfolio?

Portfolio limit structures for commercial real estate lending vary by detail and approach. The Australian major banks have struggled to uplift data and management information system. This has clear implications for the veracity of portfolio limits that govern the risk profile of commercial real estate lending portfolios. It also constrains the ability to deliver meaningful and timely insights. In it’s Insight Issue 4 2018: Strictly business: an update on commercial real estate lending APRA noted that in response to its CRE thematic review in early 2017, “…banks had put in place tactical solutions to data and management information system gaps while preparing longer correction”. It is unclear whether the Australian major banks have the capability to monitor performance of their commercial loan portfolios especially as they continue to struggle with multiple legacy systems.

On the other hand, UK banks were forced during the GFC to invest in data and systems to provide meaningful risk management insights to their shareholder (UK Government) and regulators. A key initiative was to capture and monitor data from rental schedules for collateral used to secure commercial real estate investment lending and aggregating this at portfolio level. This capability has allowed these banks to identify opportunities to grow market share as well as quickly identify clusters of higher risk exposures.

Portfolio management and risk insight is also challenged by the timeliness of data. Much of the information supporting current approaches is gathered at origination of a new loan, however, it quickly becomes stale soon after the loan is funded. In addition, annual reviews occur at least once every 12 months and are typically based on financial statements that can be over 12 months old.

Turning data into insight and opportunity

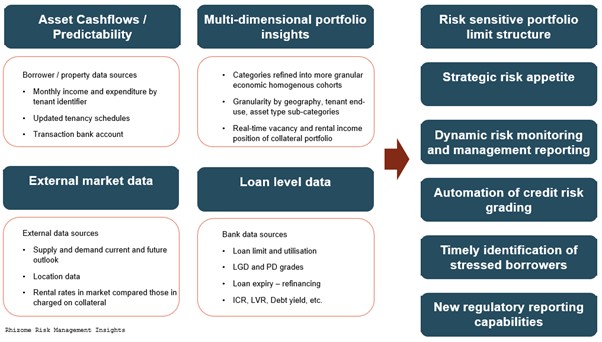

The diagram below provides a high level example of data that can be used to determine cohorts of collateral that have similar economic characteristics, timely identification of stressed or non-performing clusters, as well as being used to define risk appetite and lending strategy more effectively.

Figure 2

History has shown that during times of economic crisis and uncertainty, decisions made by large banks to tighten appetite or address portfolio concentrations has been based on imperfect or very broad assumptions of inherent risk profile. These have created temporary opportunities for small, responsive and more disciplined lenders to grow market share and earn superior risk-adjusted returns.

Additionally, as lenders continue to revalue collateral for existing exposures any deterioration in collateral values may result in additional capital being held (through migration of exposures to higher risk-weights) by the banks that use the internal ratings based approach to calculating capital (i.e. the major banks). There is the potential that for some lenders, reducing exposures may be more beneficial from a return on equity perspective. We’ll explore this idea further in a separate insight article.

Continued evolution in approaches

Sophisticated lenders are now challenging the traditional assumptions used to cluster risk types. Some of these lenders are looking at geographic diversification not in terms of broad geographies (metro and non-metro) but rather in terms of smaller and economically homogeneous areas. A key competitive advantage is to understand how dynamics change (as it has very quickly), and enable the ability to target specific sectors of the market for new origination – especially those that might be over looked by other players with less-sophisticated approaches.

Disclaimer:

This communication provides opinions which are current at the time of production. The information contained in this communication does not constitute advice and should not be relied on as such. Professional advice should be sought prior to any action being taken in reliance on any of the information.