In its November 2021 Information Paper on the Macroprudential Policy Framework, APRA highlights its expectation that ADIs are appropriately pre-positioned to be able to control growth and the composition of lending, if needed. In this Rhizome Risk Insight Article, we explore what you need to consider in managing high debt to income (DTI) portfolios.

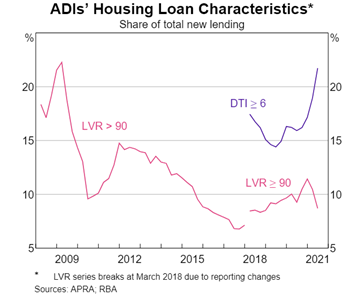

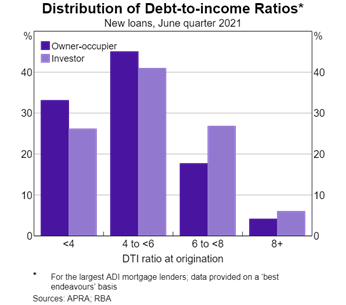

The share of new housing loans provided to highly leveraged households are at record levels. This high leverage segment of borrowers (i.e. with debt-to-income (DTI) ratios greater than 6 times) has increased from 14.3% in June 2019 to 21.5% in June 2021 of new quarterly loans funded.

In October 2021, APRA increased the minimum interest rate buffer that banks’ use in their residential mortgage serviceability assessments by 50 basis points to 3.0%. The move by APRA is expected to have a self-acknowledged modest impact on the availability of credit and is unlikely to directly address concerns regarding the growth in new home loans with DTIs greater than 6 times and the increasing portfolio concentrations in this higher risk segment.

Given the expected modest impact of the recent intervention, speculation remains that APRA may also introduce additional macro prudential measures to limit the proportion of new loans with DTIs greater than 6 times soon. This potential measure will require additional effort from banks to implement and manage compared to alternative interventions such as increasing the interest buffer and/or floor used in serviceability assessments. However, a DTI measure will certainly address the problem that APRA might be looking to solve which is the growing concentration of highly leveraged borrowers in mortgage portfolios.

December 2021 will be telling, when APRA publishes its quarterly ADI statistics which will report the status of new originations for the quarter ended 30 September 2021. The latest data on loans with DTIs greater than 6 times may put additional pressure on APRA to intervene in a more meaningful way. Whether or not APRA intervenes, banks need to consider how they manage higher DTI concentrations in mortgage portfolios as well as understand the implications that a potential DTI macroprudential measure will have on origination processes to ensure compliance.

Risk appetite settings

APRA’s definition of debt-to-income ratio in Reporting Standard ARS223 Residential Mortgage Lending is

“the ratio of the credit limit[1] of all debts held by the borrower, to the borrowers’ gross income[2].”

Most banks have a risk appetite setting limiting the flow of new housing loans funded with DTIs greater than 6 times. It is also a data point that is collected in APRA’s ARS 223. ARS 223 notes that this information must be the product of processes and controls that have been reviewed and tested by the external auditor of the bank to ensure the accuracy and reliability of the information.

If there is no risk appetite setting limiting for this metric in your credit risk appetite, it is likely that APRA will recommend that it is included to reflect better practice observed in the industry. It also means that if you move outside of the risk appetite setting you will need to take action to remedy the breach.

APRA does not collect DTI data on a portfolio basis, nor do many ADIs have access to this information. Setting a measure solely on flow does not provide the complete picture of the concentration at a portfolio level, which is what banks are looking to manage with such a measure. Banks that have access to portfolio level DTI data can measure concentration risk and justify why a period of higher flow is acceptable especially for banks with relatively low portfolio concentration to high DTI borrowers.

Do borrower(s) disclose all their income?

Certain borrowers may not need to disclose all income in their loan applications. It is likely that an additional step may need to be introduced into credit assessments. This is for certain circumstances where the borrower(s) has passed the serviceability assessment but has a DTI greater than 6 times and there is the need for the broker or bank to investigate whether they have any other income (not already disclosed).

Banks may want to double check that there isn’t any additional undisclosed income at the initial application stage, especially if the DTI is above 6 times before progressing the application process.

Such sources could be dividends, interest income, the income of a joint applicant or other types of investment income. This is less of an issue for banks that use technology solutions that scrape and analyse bank statement data to identify additional expenses but also additional income.

Need for additional verification processes?

All income sources most likely will need to be verified. For some banks, extra verification processes for additional income sources are not typically undertaken when this income is not needed when the borrower(s) has passed the serviceability assessments (especially for more complex applications). For these banks, the introduction of a DTI measure may mean additional sources of income need verification.

There may also be the opportunity to introduce additional information sources to verify gross income. One source could be gross income used in annual income tax assessments for individuals (before applying deductions and other adjustments) to identify and quickly verify the gross income value for borrowers.

However, the issue with using annual income tax assessments is the timeliness of the data and relevance for some structures such as trust income. Another key consideration is what this means for the customer experience in their origination journeys and whether additional processes delay the time to decision for customers. It is important that design and implementation of additional controls or processes are optimised so that there is no unnecessary friction in the process.

Is disclosure of a borrower(s) total credit limits of all debts an issue?

The numerator in the calculation of DTI ratio is the total credit limits of all debts held by the borrower. Historically, banks have found it challenging to identify undisclosed debts for the purposes of assessing serviceability. This is no longer a problem, as banks now use comprehensive credit reporting to identify undisclosed debt obligations in the credit assessment process. Therefore, no change in process is expected.

Beware of rationalisations!

Regulators, boards, and executives may hear or use various rationalisations justifying why concentrations to this segment are acceptable.

The Council of Financial Regulators meeting minutes published in Sept 2021 noted:

“The Council is mindful that a period of credit growth materially outpacing growth in household income would add to the medium-term risks facing the economy, notwithstanding that lending standards remain sound,”.

However, Boards and executives should be asking:

- Do borrower(s) with high DTIs represent a higher risk of default or loss?

- Despite “lending standards remain sound” or not changing (i.e. continue to meet income serviceability assessments), why are borrowers increasing their appetite for leverage?

- If high DTI borrowers represent a higher risk characteristic, what is an acceptable portfolio concentration of this segment (similar to other segments such as high LVR, investor, interest only risk appetite metrics)?

How do you get visibility of the flow to ensure compliance especially if you are close to the limit?

One of the biggest challenges with managing a potential DTI measure is the ability to get visibility of the volumes that will be funded in a quarter.

APRA’s DTI measure is recorded as the value funded rather than value approved. As seen with previous interventions, such as interest only and investor lending, several banks were challenged managing the flow and rationing credit out.

Banks with better systems and analytical insights will be better positioned to manage the process to ensure compliance with any regulatory or board risk appetite requirements.

What are your levers to manage volumes through this period?

If higher DTI loans represent a higher risk borrower, banks will look to price for this higher risk. This was the outcome of previous macroprudential interventions, firstly with higher interest rates for all investor home loans, and then for interest only loans.

Nevertheless, investment loans, interest only, and higher DTI loans when considered in isolation do not necessarily represent a higher risk of expected loss. More sophisticated mortgage originators are developing models that take in to account multiple variables that drive expected loss and run pricing strategies pricing for that risk. Risk based pricing is not yet there in the Australian residential mortgage market but it is certainly on the horizon.

How can Rhizome help?

We have assisted banks with portfolio reviews, credit risk appetite design, reporting and review across large, medium and small ADIs. This includes workshops with Boards and executive teams. We have an unparalleled understanding of APRA’s credit risk regulatory requirements and the practical implications of implementation.

Please reach out to us for more information.

[1] Includes the credit limit of any debts, such as other mortgage lending, personal loans, credit-cards, consumer finance, margin lending and any other debts held by the borrower, to any party, to the extent this is known to the ADI.

[2] Borrower’s annual before tax income, excluding any compulsory superannuation contributions and before any discounts or haircuts under the ADI’s serviceability assessment policy.

This communication provides general information which is current at the time of production. The information contained in this communication does not constitute advice and should not be relied on as such. Professional advice should be sought prior to any action being taken in reliance on any of the information. Rhizome Advisory Group Pty Ltd shall not be liable for any errors, omissions, defects or misrepresentations in the information or for any loss of damage suffered by persons who use or rely on such information (including for reasons of negligence, negligent misstatement or otherwise).