Credit risk management priorities in 2023: in this Risk Insights piece, we highlight four key credit risk issues to keep in mind when lenders are reviewing credit risk management strategies and appetite for the year ahead.

Four key issues

2023 will be the year that tests the resilience of loan portfolios and collections capabilities as the impacts of higher interest rates and inflation start to bite. The unprecedented record low interest rates, generous government support packages, substantial quantitative easing by central banks, temporary moratoria on insolvencies and regulatory concessions were unusual but necessary measures.

Emerging from the pandemic, many households and businesses are highly leveraged. Inflation is higher today than it has been for 40 years and interest rates are higher than they have been for 13 years. Few borrowers have experience in managing through this environment. Traditional credit risk strategies and assumptions used to originate new loans and manage problem assets and provisions may no longer be as relevant in this ‘new normal’.

1. Adequate capacity, capability and solutions to manage materially higher volumes of distressed and defaulted borrowers.

2. Reassess assumptions and performance of credit models developed on historical data.

3. Continue to enhance existing portfolio management, monitoring and reporting to proactively identify and manage emerging areas of borrower stress.

4. Assess resilience of commercial real estate loan portfolio performance to declining valuations, lower rental income and higher interest rates. Consider implications for covenant breaches, refinancing risk and ultimately regulatory capital and provisioning.

Collections and problem asset management strategy

Lenders made considerable improvements in their capabilities and capacity to handle stressed and defaulted borrowers during the pandemic. However, much of this was also supported by various regulatory and legislative concessions which permitted (on a temporary basis) automated deferral processes without any material downstream implications for regulatory capital, arrears, and losses.

There are many challenges for lenders as they approach a period of heightened borrower stress and default without the benefit of any of the operational and regulatory concessions afforded to them during the pandemic. Insufficiently managed, outcomes could include:

- Potential to breach lending codes of practice and legislative requirements is expected to be higher without the appropriate controls and governance structures. If not managed adequately, lenders will be exposed to higher levels of operational, conduct and reputational risks.

- Poor assessment processes and credit risk decisions will result in higher losses for both borrowers and lenders if not managed by experienced work out / collections resources.

- Ability to attract and retain experienced collections / work out staff remains a challenge especially for smaller lenders. It is important that lenders have experienced staff that can have the right types of conversations with borrowers about their circumstances, undertake high quality credit assessments and apply judgement to decisions.

- Capability of collection systems, many of which are at end of life. Many lenders have not used pandemic lessons to drive investment in new systems.

What to do

For business and consumer lenders, review and update your collections and problem asset management plans. Key areas of focus should include:

- capacity of resourcing and adequacy of systems to handle materially high volumes of more time consuming and complex activity;

- capabilities of resources and systems to facilitate conversations with borrowers that are facing distress, vulnerable borrowers, and more complex arrangements. This includes appropriate allocation of delegations to make decisions on behalf of the bank;

- appropriateness of solutions that are offered to borrowers. Temporary deferral or loan repayment solutions applied during the pandemic may no longer be appropriate for many stressed borrowers in the current environment. For example, loan capitalisation at higher interest rates has the potential to push borrowers with high LVRs into negative equity; and

- understanding the downstream economic and regulatory impacts associated with an increasing proportion of the portfolio in stress including capability for updating and testing of scenarios to understand the implications of activity and quality of decisions in the collections functions.

Automated decision models – more false negatives and positives

Lenders use a multitude of credit models in their operations. Many consumer lenders use credit decision models that generate automated decisions based on credit scoring models and decision engines with many application rules. Business lenders rely on sophisticated models that calculate estimates of probability of default, loss given default and expected loss which are used in underwriting standards, portfolio management, risk appetite, regulatory capital and provisioning.

Lenders need to reassess whether the assumptions and methodologies remain appropriate.

For example, these models have been developed using historical financial information and limited default experience influenced by regulatory concessions, government support, record levels of liquidity, and low interest rates. Along with changing economic and consumer dynamics, these may not be reflective of reality going forward.

Decisioning models should continue to be reviewed to ensure that they remain reliable. In the current competitive environment, lenders cannot afford to be unintentionally declining applications that would meet risk appetite or vice versa for both business and consumer lending.

In addition, better credit decisioning and pricing for risk ensures that transactions are approved within risk appetite, with future upside for expected credit losses and driving better and more sustainable returns on equity.

What to do

- Review model assumptions and design to ensure they remain relevant for the context that businesses and households are operating, including overreliance on past historical default experience, expected sustainability of earnings post pandemic, impacts of higher inflation and interest rates etc.

- Revisit decisioning rules and incorporate changes where more forward-looking credit judgement is required, whether that be the types of information collected, or the need for referral rules to be added so that the application can be manually assessed by a credit officer.

- Explicitly examine and make a clear call on the trade-off during this period for higher referral rates and manual decisioning against better credit decisioning and loss of bankable new applications that are within appetite

Greater demands on reporting of problem assets and provision reporting

Lenders are continuing to enhance existing portfolio management, monitoring and reporting to proactively identify and manage emerging areas of borrower stress and improve management and board oversight of problem asset management practices. This also includes the regulatory and accounting classification of non-performing and restructured exposures.

Regulatory reporting – having a deep understanding of the regulatory and accounting implications associated with implementing the various restructuring solutions on provisions, arrears reporting, and capital is critical. Regulatory requirements and expectations have changed with the implementation of the new Prudential Standard APS 220 Credit Risk Management which was effective from 1 January 2022 and the revisions to the regulatory capital framework in APS 112 and APS 113, effective from 1 January 2023. There are a number of nuances to the changes and there is a risk that banks are not correctly classifying exposures which may result in errors in regulatory reporting and capital calculations. Such errors may lead to regulatory intervention including fines.

Thinking through these scenarios at this point in time and understanding the implications is especially important.

Portfolio reporting – timely and reliable data of portfolio characteristics and account management activities is essential. Data and portfolio reporting will remain a challenge for those lenders that have not invested in collections and credit risk management systems.

What to do

Review and update your collections and problem asset management monitoring and reporting. Key areas of focus should include:

- Adequacy of reporting to provide meaningful insights into characteristics, trends and outlook for the risk profile of portfolio segments. These include borrowers that continue to meet repayment obligations but have limited resources / income buffer to meet any unexpected expenses, borrowers that have contacted the lender asking for help that may or may not proceed to submitting a hardship or any other types of temporary concession, and those that cycle through early and late stage arrears buckets, through to impairment testing and provisioning.

- Assurance plans should include frequent review and oversight of subjective judgement used to determine regulatory classifications and provisioning. It is important that they continue to challenge the extent that loan restructures are not masking real non-performance and defaults (e.g. extend and pretend, multiple extensions, switching from P&I to I/O).

Commercial property lending valuations and refinancing risk

How resilient are commercial property loan portfolios in a scenario where there is yield expansion and a tenancy recession (lower rental income) combined with higher interest rates? What does this mean for potential refinancing risk and covenant breaches in these portfolios (i.e. will borrowers be able to refinance at underwriting standards for new originations)? Will they be able to remedy covenant breaches?

Commercial property valuation declines are yet to materialise given the lack of price discovery (no consistent recent sales data) for many market and geographic segments. In addition, a number of segments are experiencing elevated vacancy rates and lower market rents. The RBA noted in its Financial Stability Review in October 2022, that “underlying tenant demand for retail and CBD office remains weak. As at June 2022, market rents for both segments were around 10 percent lower than pre-pandemic levels”.

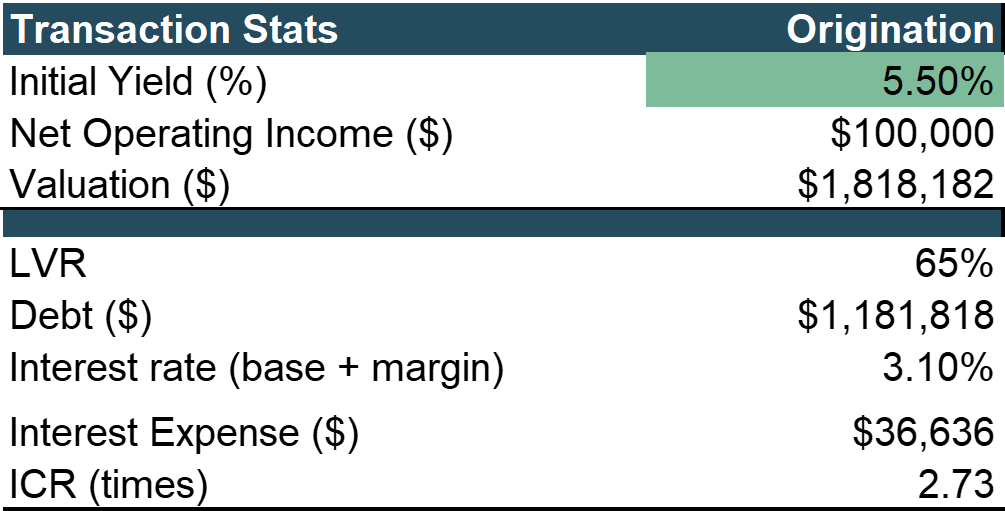

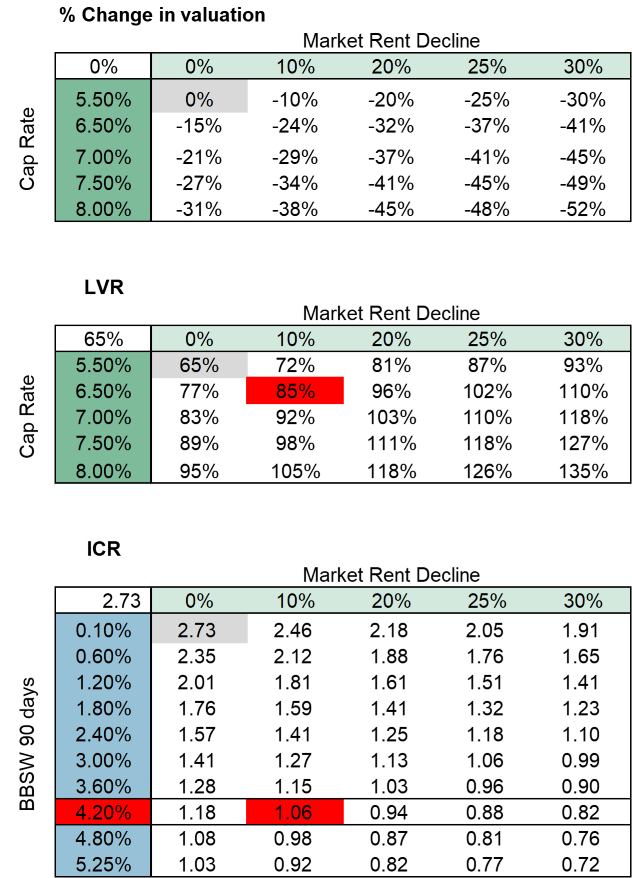

Table 1 illustrates the impact of higher interest rates, higher asset yields and lower market rents on valuations, LVRs and ICRs. In this hypothetical example, an increase in asset yield by 1% (at levels still below historical highs) and decline in rents of 10% results in the LVR increasing from 65% to 85%. The ICR decreases from 2.73x to 1.06x based on BBSW 90 days (i.e. base rate used by many lenders) increasing from 0.10% to 4.20% p.a. (based on market outlook).

Many exposures originated in the recent past using “conservative” underwriting standards (e.g. LVRs of 65% and ICR above 2.50x) are at risk of not being repaid at maturity of the loan. Our hypothetical example shows that there will be borrowers that need to decrease leverage (pay down debt) ensuring that loans can be successfully refinanced at the underwriting standards for new loans. In some instances, the loans will be restructured or borrowers may need to sell assets to repay these loans.

Do you have the portfolio insights to know whether this will apply across all tenants and property types in your commercial property portfolios?

TABLE 1: Hypothetical CRE loan example

For example, changes in ICR and LVR metrics as illustrated in the hypothetical example in Table 1 would result in a substantial deterioration in the PD grade of this borrower. This would likely result in the exposure moving into Stage 2 or 3 provisioning and the change in provision amounts.

What to do

- Increase monitoring of property performance by requesting frequent and up to date information including tenancy profiles to understand the underlying cashflows that support the servicing of debt but are also a driver of valuation.

- Early identification of borrowers showing signs of deteriorating cashflow (higher vacancies, lower rental income, mix of tenants, updated WALEs) which should trigger proactive discussions and plans to restore the borrower to health.

- Review and adjust underwriting standards for new loans. This includes appropriateness of maximum LVR and other debt sizing metrics contained in credit policy and underwriting standards especially if there is greater uncertainty contained in the valuation reports (e.g. use of special assumptions, lack of timely and reliable comparable sales and lease history, use of disclaimers etc).

- Review approaches to stress / scenario testing valuations for new credit assessments. This may include use of worse case (bottom of the cycle) asset yields / capitalisation rates to ensure that there is sufficient collateral coverage when there are concerns about the reliability of valuations (especially if declines in valuations / prices are likely to materialise over the next 12 to 18 months).

- Run a combined asset yield expansion and tenancy recession scenario across your portfolio to understand the vulnerabilities and put in place the right metrics that will drive action where it is necessary. Such vulnerabilities include potential migration in PDs and the impacts on regulatory capital and provisioning.

- For example, changes in ICR and LVR metrics as illustrated in the hypothetical example in Table 1 would result in a substantial deterioration in the PD grade of this borrower. This would likely result in the exposure moving into Stage 2 or 3 provisioning and the change in provision amounts.

How can Rhizome help?

Rhizome has assisted banks with independent credit reviews consistent with requirements in APS 220 and APG 223, credit risk appetite design and lending strategies, reporting and review. This includes workshops with Boards and executive teams. We have an unparalleled understanding of APRA’s credit risk regulatory requirements and the practical implications of implementation.

Please reach out to us for more information.

This communication provides general information which is current at the time of production. The information contained in this communication does not constitute advice and should not be relied on as such. Professional advice should be sought prior to any action being taken in reliance on any of the information. Rhizome Advisory Group Pty Ltd shall not be liable for any errors, omissions, defects or misrepresentations in the information or for any loss of damage suffered by persons who use or rely on such information (including for reasons of negligence, negligent misstatement or otherwise).