In the wake of the Hayne Royal Commission, multiple changes have been made to the superannuation laws particularly, and the financial services laws generally, with an overarching goal of improving outcomes for members, both in the accumulation and retirement phases. When implemented, the Financial Accountability Regime (‘FAR’) will add an additional layer and level of complexity to the regulatory infrastructure and compliance obligations of Registrable Superannuation Entity (‘RSE’) licensees and their executives.

After three iterations and much debate, the FAR Bill finally passed through Parliament in September 2023 – this means that the regime will apply to insurance firms and RSE licensees in March 2025. Although it seems like a relatively long lead time (on top of an even longer build up), experience with the predecessor Banking Executive Accountability Regime (‘BEAR’) suggests that such a fundamental shift in how entities and executives are expected to behave takes significant time and energy to implement. For super fund trustees, the time for action is now.

Recap: what is FAR and what does it mean for me?

The FAR creates a new set of obligations for both RSEs, and their executives and board members – known as ‘accountable entities’ and ‘accountable persons’. Fundamentally, these are obligations for executives and directors to conduct business honestly, with integrity and with sufficient care and skill; and for the RSE to create and enforce accountability structures to support this. The obligations come with notification requirements to the regulator (both ASIC and APRA) and substantial penalties for breaches.

Key to the regime is the requirement for RSEs to take reasonable steps to:

- Conduct business with due care, skill and diligence

- Deal with the regulator in an open, constructive and cooperative way; and

- Ensure accountable persons meet their obligations

In addition the RSE must:

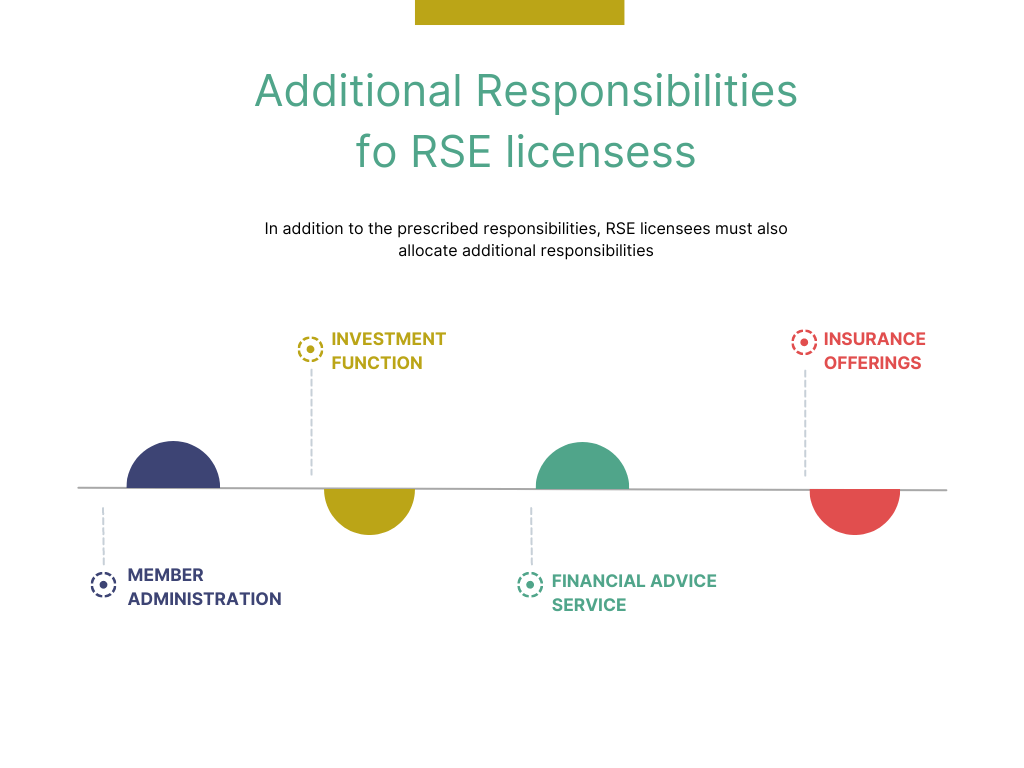

- Allocate all responsibilities

- Defer variable remuneration of accountable persons by at least 4 years and have a policy in force to reduce variable remuneration by at least 40% where there is non-compliance; and

- Notify the regulator about:

- Changes to accountable persons

- Remuneration decisions resulting from non-compliance

- Breaches of accountability obligations

What are the obligations if I am an accountable person?

Accountable persons must conduct responsibilities:

- With honesty, integrity, due skill, care and diligence; and

- By dealing with the regulator in an open constructive and cooperative way

In addition, they must take reasonable steps to prevent matters arising that would (or would be likely to):

- Affect the prudential standing or reputation of the entity (including in eyes of general public); or

- Result in a material breach of the financial services laws (including the Superannuation Industry (Supervision) Act 1993 (SIS Act) (noting that a large number of minor breaches could add up to material breach).

Key considerations for superannuation trustees, RSE licensees and executives

Importantly, the FAR extends beyond the RSE licensee to related entities. For superannuation, in addition to the general rules around subsidiaries, RSE licensees must also take steps to ensure that other connected entities comply with the accountability obligations, where they have a material and substantial effect on the RSE licensee. This is intended to ensure that where major functions are outsourced, these are captured by the obligations. This adds an additional layer of complexity to effective ongoing implementation of the regime, as not only will the RSE have to ensure its own frameworks support accountability, but also contend with multiple distinct organisations with which relationships will vary. It may become apparent through this process that certain business models are no longer desirable.

Everything looks clearer with the benefit of hindsight: implementation risks and considerations

Interaction with other components of superannuation regulation

Upon commencement of FAR, RSEs will have an even more complex set of overlapping and interlinking obligations. Because FAR brings in the provisions of the various financial services laws, executives are obligated to take reasonable steps to prevent breaches of the laws. Unlike member outcomes, design and distribution obligations, the best financial interests duty and the retirement income covenant, which focus on outcomes, the FAR can be viewed as more of an inputs based regime. If the inputs – executive honesty, integrity, care, diligence and skill – are right, then the outcomes should follow. In this way, the FAR can be seen as a complementary tool for both regulators and RSEs in achieving good outcomes for members and ensuring compliance with the raft of new legislative requirements.

When outcomes are negative – prudential standing or reputation is damaged or financial services laws are breached, regulators will come with a hindsight lens – and the RSE licensee and executive must demonstrate that they took reasonable steps to prevent this. The legislation provides some guidance on what constitutes reasonable steps including governance, control and risk management; safeguards against inappropriate delegation; appropriate procedures for identifying and remediating problems; and appropriate action in respect of non-compliance or suspected non-compliance. Although useful, these guidelines provide only a very high level indication of what will be necessary, but not sufficient, to ensure compliance.

RSE licensees will also need to satisfy themselves that they have created both the right infrastructure to enable reasonable steps to be taken, by the entity and the executives, as well as cultivated the right mindset and behaviours among executives. The former is typically simpler, but should not be taken for granted. Although in a perfect world, all organisations would already be governed in such a way, the reality is that there are often gaps. These can be hard to detect from inside the organisation and often only become apparent after something has gone wrong. For example, in its October 2021 review, APRA noted that with respect to the best financial interests of members, in some RSEs, neither the decision-making nor the post-implementation analysis of marketing expenditure were sufficiently rigorous. These kinds of governance gaps could clearly lead to a breach of the FAR, and, particularly where such poor processes resulted in detriment to members, regulators would seek to hold executives to account.

Despite the fact that end-to-end product responsibility is unlikely to be prescribed, product governance remains at the forefront of ASIC’s work, with one of four external priorities in its 2022 Corporate Plan being product design and distribution. Although the design and distribution obligations are expected to catch potential harm before it occurs, ASIC explicitly links FAR and product design and distribution, and we have no doubt that where things do go wrong with products and consumers suffer, ASIC would be looking to hold individuals to account under FAR.

Application of consequences

Even without the individual civil penalties for accountable persons originally drafted in FAR legislation and favoured by the Greens, the consequences for failing to comply are high. Regulators’ powers to direct are significant – ranging from specific action and audits, all the way to major organisational restructure. They may also direct the RSE to reallocate responsibilities among executives. Civil penalties up to 2.5m penalty units (almost $700m at the time of writing); or 3 times the benefit derived by the entity by avoiding the obligation can be applied. Along with the remuneration consequences, an individual may be permanently disqualified from acting as an accountable person. Importantly, RSEs are made responsible for using remuneration to enforce executive responsibility.

By building in variable remuneration consequences, lawmakers are relying on the fact that financial executives, like most people, respond to incentives. Rather than civil penalties for individuals, the FAR has recruited firms to impose costs on executives. This means that RSE licensees must have variable pay arrangements in place, and use them as a way to incentivise compliance with the obligations. How this is done, especially in the early days of the regime, will be important in setting the tone in the organisation around accountability. Regulators will be scrutinising this closely.

Of course, a threat to their pay will likely put accountability obligations at the forefront of executives minds, however, an array of other factors drive behaviour – including in particular the social context, but also the environmental architecture, including governance structures, technology and access to information. It is incumbent on the RSE licensee to first understand and then work to change those aspects of the organisation that don’t enable and encourage honesty, integrity and compliance or support the taking of due care.

Turning the risks into an opportunity

For the super sector, FAR provides an opportunity to both identify the need to change, and to actually drive that change. Having the right framework in place well before the obligations become law gives time to identify gaps and friction points before the regulators do it for you.

While allocating responsibilities and mapping accountability may seem relatively straightforward, creating the structures and environment for executives to effectively discharge these responsibilities and embedding and operationalising the obligations will be more complex. The long implementation period of the legislation should be seen as an opportunity to plan, test and learn how individual accountability works within your business model.

Rhizome works with firms across the financial sector in the design, implementation and ongoing management of accountability frameworks. We support firms in demonstrating reasonable steps by designing and refining methodologies, conducting reviews and assessing how accountability works in practice at different levels within the firm, turning accountability into a meaningful competitive advantage.

Please reach out to us for more information.

This communication provides general information which is current at the time of production. The information contained in this communication does not constitute advice and should not be relied on as such. Professional advice should be sought prior to any action being taken in reliance on any of the information. Rhizome Advisory Group Pty Ltd shall not be liable for any errors, omissions, defects or misrepresentations in the information or for any loss of damage suffered by persons who use or rely on such information (including for reasons of negligence, negligent misstatement or otherwise).